Rising inflation often creates a heightened sense of focus, moving your attention to the importance of sound business practices. Namely that of planning ahead, anticipating and organising things to withstand a difficult market.

As millions of people look intently at the subject, many are discovering both stable traditional principles of old and new cutting-edge techniques (allegedly holding the promise for a brighter global economy). If you are seeking to protect yourself against inflation or perhaps even improve your fortunes during such difficult times, then you may find this useful. Below is a brief account of the underlying issues and overview as to how companies typically strategize in response to inflation-related risk.

What Does Rising Inflation Mean for You or Your Business?

Inflation: A Brief Primer

Inflation is how economists measure the rate at which goods and services rise in relation to the value of their currency. This occurs when the prices of those goods and services rise due to an increase in production costs, raw materials, and wages. Surging demand can also cause inflation, because businesses know that they can dramatically raise their prices without a significant reduction in demand.

Because rising inflation can occur across a country's economy at a large industrial scale or within entire sectors, it has the potential to impact both common everyday necessities and luxury items. Its effects often cause consumers and businesses to expect a prolonged negative impact upon their spending capacity (whether based upon data and a sound rationale, or driven by irrational and fear-based thinking). Individuals on mass begin preparing for the worst, compounding the issue.

This makes people far less likely or able to spend on luxuries, businesses less likely to innovate, recruit, expand or explore new products, making inflation-related business risk a necessary consideration. Even if you generally have a positive outlook, it becomes difficult to ignore. As domestic households and commercial businesses respond to inflation gripping an economy - eventually it effects everyone.

Inflation issues are common to all countries with central banking systems. Whilst banks function more or less autonomously from the governments they operate alongside, it has been harder and harder to tell just how much influence politicians have over the banks. By way of background, the majority of the world's central banking assets are controlled by:

- China

- Japan

- Washington, D.C.

- The City of London

- The eurozone in general.

Given our modern times and the inter-connected nature of our global economies, it is hardly surprising to see that any major economic bump for a super power, will create problems worldwide. As inflation reducing the purchasing power of our currencies day-by-day, this is driving huge public interest in the true nature of fiat currency (money) and its effectiveness.

Human creativity and our problem-solving minds have begun centring their efforts on the challenges associated with centralised banks, or at least banking as we have known for so long. Enter challenger banks, online only banks and crypto-currencies. One thing is for sure, we can expect the industry to continue evolving and changing, so you ought to watch this space.

Staying Investor-Friendly

When uncertain economic conditions leave investors wary of new investments, those that show or prove to be resilient can seem like a diamond in the rough. The companies that weathered the 2008 financial recession were the ones that primarily did two things well:

- Based their price increases closely on the Producer Price Index (PPI); and/or

- Significantly cut costs and expenses

The PPI measures the price of goods after production. How closely a company's prices are aligned with production costs is one of the clearest indications of the stress they are under. It essentially expresses to the world and to investors that they have little need to raise their prices, because they are maintaining their necessary profit margins through superior internal business practices. It reduces the perception that the company has inflation-related business risks that they are trying to offset.

Cutting Costs

This is most effectively done through cost-cutting measures, which allows for an increase in profits without increasing the cost of products. Thereby keeping consumer demand and shareholder returns high. During the 2008 financial crisis, an HBR study showed that the median shareholder return was 27% higher for companies that focused on cutting costs, even when they didn't have to. They stood in stark contrast to companies that continually raised their prices rather than look for other methods of saving expenses.

Cutting Waste

Other methods businesses use to maintain their attractiveness to investors or owners are those aimed at tightening efficiency. This can be harder to measure than costs. Rather than throw things off-the-deck of a sinking ship, hoping that a lighter weight will delay or prevent the inevitable. An effort to fix the actual leak is often necessary to truly keep the ship afloat.

The lean management philosophy, made famous by Toyota, is one example of how a company sought to quantify factors impacting performance. Measuring metrics and applying or monitoring performance vs. targets, is a practice every forward-thinking business should adopt.

Using Lean Management and similar techniques, the following factors can help companies stay competitive while keeping prices lower than their competitors:

- Make lead times for product replenishment shorter – but make the production lines more flexible

- Focus efforts on root problems that are slowing production speed

- Find an organisational solution to everything (redefine workflows if needed)

- Study and eliminate non-value-add activity

- Pay as much, or more, attention to refining processes vs. bottom-line results

- Ask "why?" more than mindlessly collecting data (and then wondering what to do with it)

- Look at the connections between processes, as much as the individual processes

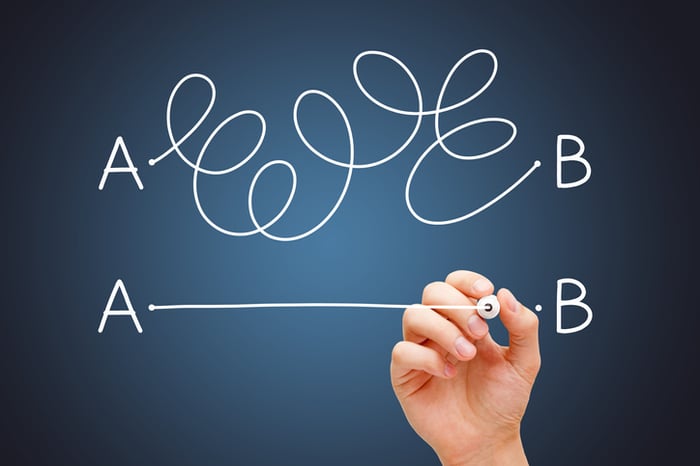

It is unceasing mental flexibility that will reveal limitless opportunities for increasing efficiency and finding new levels of performance in your business. Most companies simply do the same thing and hope for the best. The ones that truly stand out, even during hard times, are those who maintain a healthy approach towards innovation. Creativity. The very mindset that reliably pulls a nation back out of recession.

Achieving a Brighter Future Together

At the end of the day, no one currency supply can physically stop people from engaging in fruitful endeavours with each other. With more public willingness to seek alternatives and more options available, many businesses not looking outside the box as the real gamble.

Spurred by the motives of public institutions and long-questioned economic policies, companies are trying to put new forms of currency into circulation like never before. One company in America is actually getting small denominational gold infused bills into circulation. There are also companies now offering credit cards that are funded by cryptocurrency, which convert immediately to the relevant fiat currency at the point of transaction.

There are fascinating takes on traditional and new methods of keeping global currencies flowing, and only time will tell which of these ideas will take hold. What is certain though, is that the creativity of humanity will eventually push economies to new levels of stability. Given enough time of course, just as they once created the systems we use today.

Tim Hatari

Tim Hatari helps businesses improve performance, creating strategic development plans and establishing structure via the 5PX Executive Business Coaching System. As CEO and Founder at TMD Coaching, he oversees the vision setting process with clients, leading on sales acquisition, the drive for operational excellence and market leading innovation. For Tim, helping others is the most rewarding part of the role. Follow or connect with Tim on Linkedin - www.linkedin.com/in/timhatari

View All ArticlesTopics from this blog: Finance, Forecasting

.png?width=470&height=394&name=Join%20Quest%201.0%20(3).png)

%20v1.png?width=470&name=Blog%20Read%20(Strategic%20Planning)%20v1.png)

%20v1.png?width=470&name=Blog%20Read%20(Credit%20Control)%20v1.png)

%20v1.png?width=470&name=Blog%20Read%20(Managing%20Inflation)%20v1.png)

%20v1-1.png?width=500&height=266&name=Quest%20(Poster)%20v1-1.png)